Effective capital allocation is a critical aspect of managing diversified portfolios, as it plays a pivotal role in achieving investment goals and optimizing returns while managing risk. The task of allocating capital across various assets within a portfolio requires careful consideration of factors such as risk tolerance, investment objectives, and market conditions. In this article, we will explore the strategies and principles that underpin capital allocation in diversified portfolios. By understanding the key concepts and examining different approaches, investors can make informed decisions to allocate their capital strategically, ultimately enhancing the performance and resilience of their investment portfolios.

Capital Allocation Principles

Effective capital allocation is the cornerstone of successful portfolio management. It involves the strategic distribution of investment capital across different assets within a portfolio. By understanding and implementing capital allocation principles, investors can enhance their portfolio’s performance while managing risk effectively. Let’s delve into the key aspects of capital allocation and its significance in diversified portfolios.

Factors to consider when determining capital allocation strategies:

Several factors influence the determination of capital allocation strategies. These include investment time horizon, risk appetite, liquidity needs, and market conditions. It is essential to consider these factors comprehensively to align capital allocation with one’s financial objectives and constraints. Additionally, factors such as economic outlook, industry trends, and regulatory changes should also be taken into account to make informed allocation decisions.

Importance of aligning capital allocation with investment goals and risk tolerance:

Aligning capital allocation with investment goals and risk tolerance is crucial for long-term success. Each investor has unique objectives and tolerances for risk. Some may prioritize capital preservation, while others may seek capital appreciation. By aligning capital allocation with these preferences, investors can ensure their portfolios are structured to meet their specific needs, minimizing the likelihood of being overwhelmed by market volatility or deviating from their risk tolerance.

The role of asset allocation and diversification in capital allocation decisions:

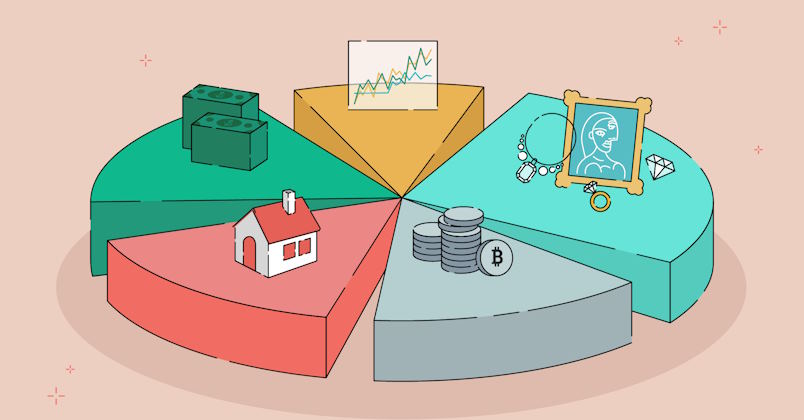

Asset allocation and diversification are integral components of capital allocation. Asset allocation involves dividing the portfolio’s capital among different asset classes, such as stocks, bonds, real estate, and cash equivalents. Diversification, on the other hand, entails spreading investments within each asset class to mitigate risk. By strategically allocating capital across various asset classes and diversifying within each class, investors can optimize their risk-return trade-off and potentially enhance portfolio performance.

Capital Allocation Strategies for Diversified Portfolios

When it comes to capital allocation in diversified portfolios, there are various strategies that investors can employ. Each strategy has its own approach and considerations, offering unique benefits and potential drawbacks. Let’s explore some popular capital allocation strategies and their pros and cons.

Equal Weighting Strategy:

The equal weighting strategy involves allocating an equal amount of capital to each investment within a portfolio. This approach ensures that no single investment dominates the portfolio’s performance. It offers simplicity and equal exposure to all holdings, potentially leading to broader diversification. However, a drawback of this strategy is that it may not consider the relative size or performance potential of each investment, potentially neglecting the impact of larger or more promising assets.

Market Capitalization Weighting Strategy:

Market capitalization weighting allocates capital based on the market value of each investment. In this approach, larger companies receive a greater allocation, reflecting their influence on the market. This strategy aligns with market trends and provides exposure to well-established companies. However, it may lead to overexposure to a few dominant stocks, increasing concentration risk and potentially missing out on opportunities in smaller or undervalued companies.

Risk Parity Strategy:

The risk parity strategy aims to allocate capital based on risk contributions rather than market value or equal weights. It seeks to balance risk across different asset classes by allocating more capital to investments with lower volatility. This approach can enhance portfolio stability and risk management. However, it requires robust risk modeling and may lead to underweighting higher-risk, potentially high-reward assets.

Factor-based Allocation Strategy:

The factor-based allocation strategy focuses on specific factors such as value, growth, momentum, or quality when allocating capital. It aims to capitalize on factors that historically drive asset returns. This strategy allows investors to target specific risk factors and potentially achieve superior risk-adjusted returns. However, it requires in-depth research and monitoring of factor performance, and excessive reliance on a single factor can lead to concentration risk.

Evaluating and Monitoring Capital Allocation Strategies

Once capital allocation strategies are implemented in a diversified portfolio, it is crucial to continuously evaluate and monitor their effectiveness. Regular assessment and adjustments are necessary to ensure optimal performance and alignment with investment goals. Let’s explore key considerations when evaluating and monitoring capital allocation strategies.

Performance evaluation metrics for capital allocation strategies:

Measuring the performance of capital allocation strategies requires the use of appropriate metrics. Commonly used metrics include portfolio returns, risk-adjusted returns (e.g., Sharpe ratio), and benchmark comparisons. These metrics provide insights into how well the strategies are delivering returns relative to the portfolio’s risk exposure and market benchmarks. Evaluating these metrics over time helps identify the effectiveness of the capital allocation strategies.

Monitoring and adjusting capital allocation over time:

Market conditions and investment goals can change over time, necessitating a periodic review and adjustment of capital allocation strategies. It is essential to stay informed about market trends, economic indicators, and shifts in the investment landscape. Regular monitoring allows for timely adjustments, such as reallocating capital to capitalize on emerging opportunities or reducing exposure to underperforming assets. By actively managing capital allocation, investors can adapt to evolving market dynamics and enhance their portfolio’s performance.

Considerations for tax efficiency in capital allocation decisions:

When evaluating and monitoring capital allocation strategies, tax efficiency should not be overlooked. Capital gains and tax implications can significantly impact investment returns. Investors should consider tax-efficient strategies, such as utilizing tax-advantaged accounts or implementing tax-loss harvesting techniques. By managing the tax impact of capital allocation decisions, investors can maximize after-tax returns and preserve more of their investment gains.