Sustainable capital management has emerged as a critical practice in today’s financial landscape, driven by the need for long-term value creation and the recognition of environmental, social, and governance (ESG) factors as key determinants of business success. As businesses face increasing pressure to address societal and environmental challenges, integrating ESG factors into capital management strategies has become a vital component of responsible and forward-thinking financial decision-making.

The Link Between ESG Factors and Sustainable Capital Management

Financial performance and ESG integration:

When it comes to sustainable capital management, integrating ESG factors goes hand in hand with financial performance. Contrary to the belief that sustainable investments may compromise returns, numerous studies have shown a positive correlation between strong ESG practices and financial outcomes. By considering environmental, social, and governance factors, companies can enhance their operational efficiency, reduce costs, and identify new growth opportunities. For instance, adopting sustainable practices that reduce energy consumption not only helps the environment but also leads to significant savings on utility bills. Furthermore, companies with robust governance structures and ethical practices tend to attract responsible investors who value transparency and accountability, thereby potentially gaining access to a larger pool of capital. In this way, the integration of ESG factors into capital management strategies can contribute to both financial success and long-term sustainability.

Risk mitigation and ESG considerations:

Integrating ESG considerations into capital management also plays a crucial role in risk mitigation. Environmental risks, such as climate change impacts and resource scarcity, can have far-reaching consequences for businesses. By evaluating and addressing these risks, companies can enhance their resilience and adaptability to changing market conditions. Social risks, including labor issues and community relations, can also impact a company’s reputation and bottom line. By actively managing these risks, businesses can mitigate potential legal, financial, and reputational damage. Furthermore, governance factors play a critical role in reducing the risk of fraud, corruption, and conflicts of interest within organizations. By ensuring sound governance practices, companies can enhance their credibility and build trust among stakeholders, which is vital for sustainable growth in the long run.

Reputation and stakeholder trust:

In today’s interconnected world, reputation and stakeholder trust are invaluable assets for businesses. ESG integration enables companies to align their operations with ethical values and societal expectations, thus enhancing their reputation as responsible corporate citizens. Consumers, employees, and investors increasingly seek out companies that demonstrate a commitment to sustainability and social responsibility. By integrating ESG factors into capital management, businesses can foster trust and loyalty among their stakeholders, which can positively impact their brand image and customer loyalty. Moreover, as stakeholders become more informed and socially conscious, companies that neglect ESG considerations run the risk of reputational damage and loss of market share. Thus, by prioritizing ESG factors, businesses can strengthen their relationships with stakeholders and build a solid foundation for long-term success.

Legal and regulatory landscape of ESG investing:

The legal and regulatory landscape surrounding ESG investing is rapidly evolving, reflecting the growing importance of sustainable capital management. Governments and regulatory bodies worldwide are introducing new frameworks and guidelines to encourage transparency and accountability in ESG reporting and disclosures. Companies that fail to comply with these regulations may face legal repercussions and reputational harm. On the other hand, businesses that embrace ESG integration and meet regulatory requirements can gain a competitive advantage, attract socially responsible investors, and access new markets. As the legal and regulatory landscape continues to evolve, it becomes increasingly crucial for financial institutions to stay informed and adapt their capital management strategies to align with emerging standards.

Incorporating ESG Factors into Capital Management

ESG integration across investment strategies:

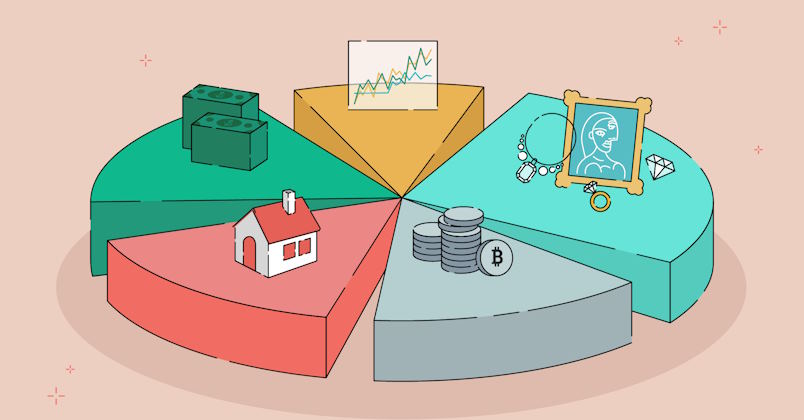

Integrating ESG factors into capital management involves a range of approaches that align financial objectives with sustainable considerations. One common approach is ESG screening, where companies are evaluated based on predefined ESG criteria, and those failing to meet the standards are excluded from investment portfolios. This exclusionary approach ensures that investments align with specific sustainability goals and values. Another strategy is ESG incorporation, where companies are assessed based on their ESG performance and integrated into portfolios based on their relative strength. This best-in-class approach allows for the selection of companies that excel in ESG practices within their industries. Impact investing and thematic strategies are additional approaches that target investments in companies addressing specific environmental or social challenges, thus aiming for both financial returns and measurable positive impacts.

Tools and frameworks for ESG analysis and evaluation:

To effectively incorporate ESG factors into capital management, various tools and frameworks are available to assist in ESG analysis and evaluation. ESG ratings and data providers offer comprehensive assessments of companies’ ESG performance, providing investors with valuable insights for making informed decisions. These ratings consider factors such as carbon emissions, labor practices, and corporate governance. Additionally, developing internal ESG policies and guidelines helps establish a structured framework for integrating ESG considerations into investment decision-making. Such policies ensure consistency and accountability while aligning investment strategies with the organization’s sustainability objectives.

Challenges and limitations of ESG integration:

While the integration of ESG factors into capital management offers significant benefits, it is not without challenges and limitations. Data quality and standardization remain key hurdles in ESG integration. As ESG data is often self-reported by companies, ensuring its accuracy and comparability across organizations can be challenging. Lack of industry-wide definitions and metrics further complicates the assessment of ESG performance and the benchmarking of companies. Striking a balance between financial returns and ESG objectives is another challenge. In some cases, investments that align strongly with ESG goals may yield lower financial returns in the short term. Achieving the optimal balance requires careful consideration and a long-term perspective.